✅ Bad Credit? No Problem: How to Get Fast Personal Loans in Hong Kong in 2025

In Hong Kong, over 1 in 4 adults has difficulty qualifying for traditional bank loans due to low or no credit scores. Life doesn’t wait for your credit to recover—whether it’s medical bills, emergency repairs, or rent payments, you need cash now, not after weeks of paperwork.

That’s where fast personal loans in HK—even for people with bad credit—come in.

💸 What Is a Bad Credit Loan in Hong Kong?

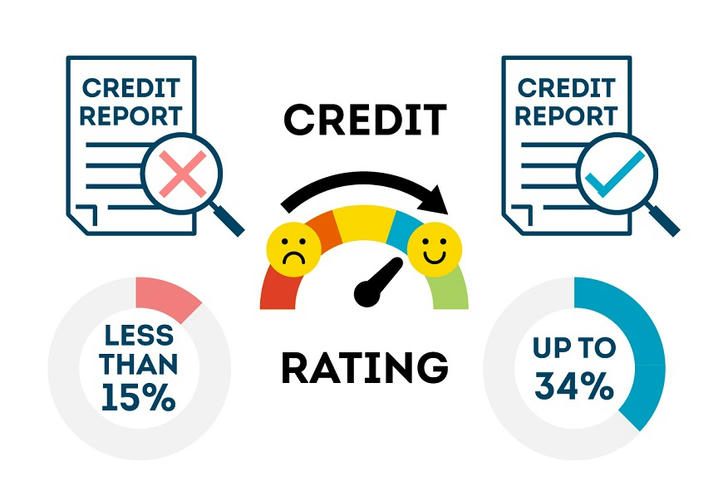

A bad credit loan is a personal loan tailored for individuals who have:

- Overdue credit card payments

- Past loan defaults

- Low income verification

- Bankruptcy history

Unlike banks, licensed money lenders or online lending platforms often provide online loan without rejection policies, offering approval in minutes—even if your credit score isn’t perfect.

⚡ Key Benefits: Why Hongkongers Are Choosing Fast Online Loans

| Benefit | Details |

|---|---|

| 🕐 Instant Approval | Get results in minutes |

| 💳 Credit Check | Soft or no credit pull from some providers |

| 🔒 Confidential & Secure | Licensed lenders must follow HKMA and OFCA guidelines |

| 💰 Flexible Amounts | Borrow HK$240 up to HK$150,000 based on your need |

| 📱 100% Online Process | No in-person visits or paperwork required |

💳 Example Loan Amounts & Monthly Payments

Here’s a breakdown of sample loan sizes and estimated monthly repayments, assuming a short-term repayment period:

| Loan Amount (HK$) | Est. Monthly Repayment |

|---|---|

| HK$240 | HK$3 |

| HK$1,500 | HK$15 |

| HK$2,400 | HK$24 |

| HK$24,000 | HK$240 |

| HK$75,000 | HK$750 |

| HK$150,000 | HK$1,500 |

📌 Note: Figures are indicative and depend on loan tenure and interest rates.

✅ Who Qualifies for These Loans?

You may be eligible even if you...

-Have a bad credit score

-Are a freelancer or self-employed

-Recently lost your job

-Are under debt restructuring

-Do not have income or address proof – only a bank card and ID are required

-No credit check needed

These bad credit loan approval Hong Kong programs are designed to assist you when traditional banks say “no.”

📲 How to Apply for a Cash Loan

Choose a Licensed Lender

- Always check the OFCA or HKMA list of approved lenders

Fill the Online Form

- Provide name, HKID, income status (if any), loan amount

Verify by SMS or Email

- Most platforms use mobile verification for added security

Get Instant Decision

- Experience quick approvals and fast access to funds with select apps.

Receive Funds

- Direct transfer to your local Hong Kong bank account

🏦 Which Institutions Offer Loans to People with Bad Credit or Bankruptcy in Hong Kong?

Even if you’ve experienced loan defaults, missed credit card payments, or even declared bankruptcy, there are licensed lenders in Hong Kong that specialize in helping you access emergency funds. Here are five trusted institutions known for working with applicants who have low credit scores or unstable financial history:

| Lender Name | Why It’s Suitable for Bad Credit / Bankruptcy Cases | Website |

|---|---|---|

| WeLend | Offers loans with no credit report requirement; approvals based on mobile data & behavior analytics, not past credit. Great for those with bankruptcy history or no proof of income. | www.welend.hk |

| UA Finance | Accepts applicants with debt restructuring and low income. Their staff are trained to evaluate risk beyond credit scores. Also accepts freelancers and gig workers. | www.uaf.com.hk |

| MoneySQ | Uses an AI-driven approval process that evaluates real-time financial behavior instead of your past. Perfect for those with recent job loss or bankruptcy discharge cases. | www.moneysq.com |

| PrimeCredit | Provides tailored repayment plans for people recovering from financial trouble. Their “Credit Relief” program is ideal for individuals with damaged credit history. | www.primecredit.com |

📌 Important: All lenders listed are licensed under the Hong Kong Money Lenders Ordinance and appear on the OFCA/Companies Registry list of legitimate lenders.

📌【Three Reminders Before Applying】

- Check the Effective Annual Rate (APR): Compare total repayment costs, not just monthly interest.

- Borrow within means, avoid overlapping debts: Monthly repayments should not exceed 30% of your monthly income.

- Choose licensed money lenders: Verify legitimacy by checking the Hong Kong Money Lenders Registry before applying.

- Be aware of hidden risks: Avoid lenders with unclear terms, unusually low advertised rates, or pressure tactics. Always read the loan agreement carefully, including repayment terms, penalties for late payment, and data privacy policies.

🙋 Final Thoughts

Having bad credit shouldn’t mean financial exclusion. In 2025, Hong Kong residents have access to personal loans within minutes that are:

- Safe

- Fast

- Fully digital

- And often, cheaper than payday loans

Don’t let your past define your future. Use these tools to cover immediate needs while you rebuild your credit.