The Smart Borrower's Guide to Credit Card Loans in 2024: Types, Costs & Pitfalls

"How a $5,000 Credit Card Loan Cost One Family $14,000 - And How to Avoid Their Mistake"

When San Diego nurse Maria R. took a $5,000 cash advance at 26.99% APR to cover her son's braces, she didn't realize the minimum payments would stretch 11 years and cost $9,000 in interest. This guide will show you better alternatives and exactly how credit card loans work.

2024 Credit Card Loan Landscape: Key Facts

- $123 billion in U.S. credit card loans outstanding (Federal Reserve Q2 2024)

- Average interest rate: 22.8% (up from 16% in 2022)

- 43% of Americans carry credit card debt month-to-month

- Cash advance fees average 5.3% ($10 minimum)

4 Types of Credit Card Loans Compared

| Loan Type | How It Works | Avg. APR | Fees | Best For | Worst For |

|---|---|---|---|---|---|

| Purchase Financing | Pay over time for specific purchases | 15-29% | Late fees only | Planned big-ticket items | Long-term debt |

| Balance Transfer | Move debt to lower-rate card | 0-5% intro (then 18-28%) | 3-5% transfer fee | Paying off existing debt | New purchases |

| Cash Advance | ATM withdrawal against limit | 25-30% | 5% + ATM fees | Absolute emergencies | Any other situation |

| Check Advances | Write special checks from issuer | 23-28% | 3-5% fee | Short-term cash flow | Anyone with better options |

Real-Life Cost Scenarios

The Good (Smart Balance Transfer)

Scenario: $8,000 debt at 24% APR

Solution: Transfer to Citi Simplicity (0% for 21 months + 3% fee)

Savings: $2,880 in interest (vs minimum payments)

Key Move: Paid $387/month to clear debt before promo ended

The Bad (Cash Advance Trap)

Scenario: $3,000 emergency car repair

Mistake: Took cash advance at 28% APR + 5% fee

Result: $150 immediate fee + $1,344 interest over 2 years

Better Alternative: Discover personal loan at 12% APR would've cost $360 total interest

2024's Best & Worst Credit Card Loans

Top 3 Balance Transfer Cards

Citi Simplicity

- 0% for 21 months

- 3% transfer fee

- No late fees ever

Discover it Balance Transfer

- 0% for 18 months

- 3% fee

- Cashback match first year

Chase Slate Edge

- 0% for 18 months

- $0 transfer fee if done in 60 days

Most Expensive Options to Avoid

🚩 Store Credit Cards

- Typical APR: 28-32%

- Example: Macy's card charges 29.99%

🚩 Convenience Checks

- Average fee: 4%

- Interest starts immediately

5 Hidden Credit Card Loan Dangers

Residual Interest

- Even if paid in full, may owe interest from previous billing cycle

Payment Allocation

- Banks apply payments to lowest APR balances first

Universal Default

- Some issuers raise rates if you're late with any creditor

Check Holds

- Cash advances can freeze 20% of available credit

Rewards Forfeiture

- Many cards don't earn points on cash advances/transfers

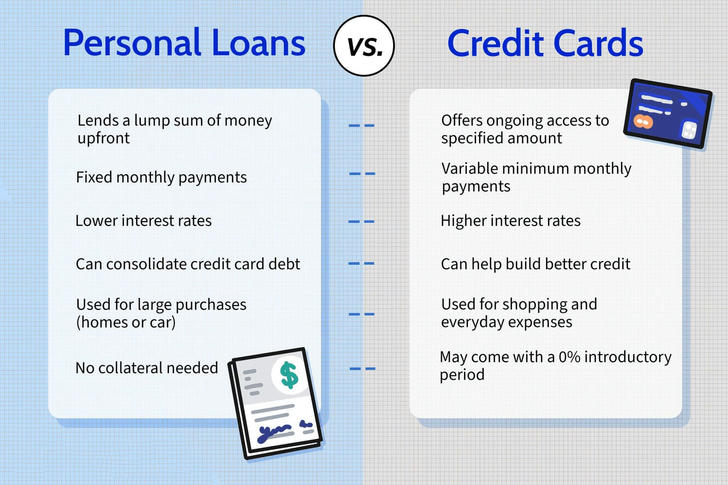

Better Alternatives to Credit Card Loans

| Option | Avg. APR | Term | When It's Better |

|---|---|---|---|

| Personal Loan | 8-16% | 2-5 years | Borrowing >$5,000 |

| 401(k) Loan | 5-8% | 1-5 years | Short-term repayment |

| HELOC | 7-10% | 10-20 years | Homeowners only |

| Paycheck Advance | 0-5% | Until payday | Small amounts <$500 |

Your 5-Step Action Plan

Calculate the True Cost

Use Bankrate's credit card payoff calculatorCall Your Issuer

77% success rate in getting APR lowered (CFPB data)Prioritize by APR

Pay highest-rate debt firstSet Up Autopay

Even $50 above minimum cuts payoff time in halfFreeze Your Cards

Literally - put them in a block of ice to curb spending

Special Considerations

For Business Owners

- Corporate cards often have higher limits

- But personal liability common

For Students

- Discover it Student offers 0% first 6 months

- Average student card APR: 18.5%

For Bad Credit

- OpenSky Secured Visa reports to all 3 bureaus

- No credit check required

Sources:

- Consumer Financial Protection Bureau

- Federal Reserve Economic Data

- J.D. Power 2024 Credit Card Study

Bottom Line: Credit card loans should be last-resort solutions - except for strategic balance transfers. With average rates nearing 23%, understanding these products could save you thousands.

Remember: The best credit card loan is one you don't need to take. But if you must, this guide ensures you'll do it the smartest way possible.